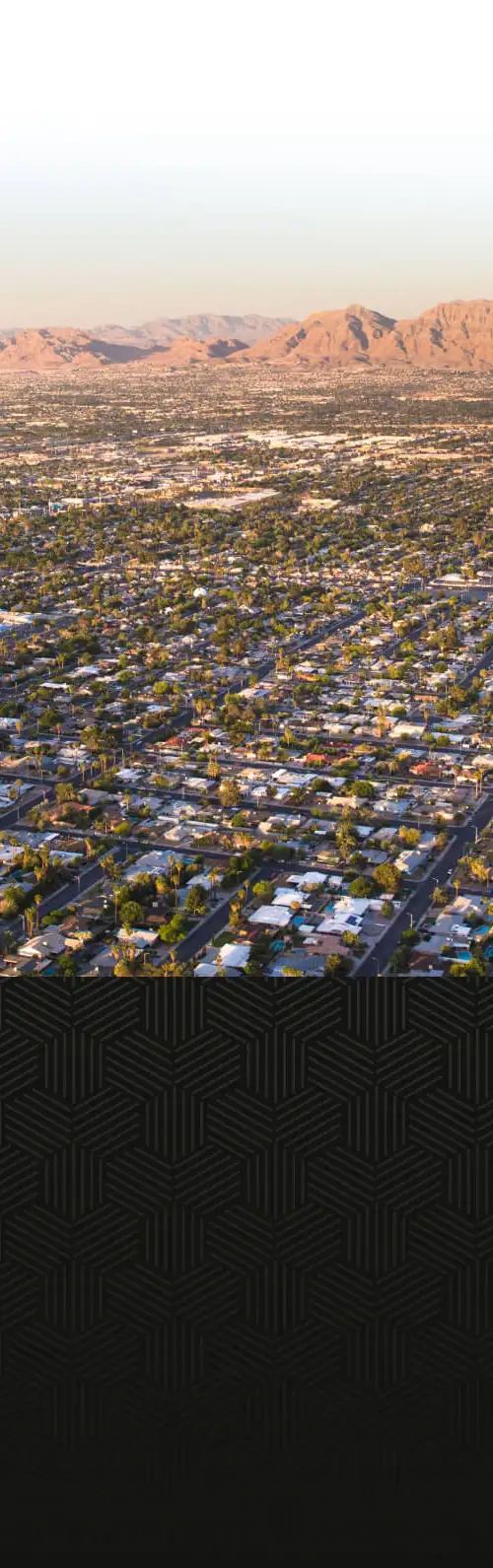

Owning a rental property in Las Vegas offers profitable opportunities, but it also comes with its fair share of risks. Securing the right owner insurance for your rental property is important to protect your investment and ensure peace of mind. Landlord insurance policies, tailored specifically for rental property owners, provide comprehensive coverage options that safeguard against potential financial losses. Whether it’s property damage from severe weather, house fires, or legal fees from liability claims, having the right landlord protection insurance policy is essential.

Furthermore, landlord policies often include fair rental value coverage, which compensates for lost rental income if the property becomes uninhabitable due to a covered loss.

What You Need To Know Before Buying A Rental Property In Las Vegas

Landlords in Las Vegas should purchase landlord insurance coverage for their rental properties. When shopping for a landlord insurance policy, look for coverage for property damage, lost rental income, liability, and discounts for safety features like smoke detectors and security systems.

In addition, it’s essential to be aware of the city’s vacancy tax, which applies to rental units unoccupied for more than 60 days in a calendar year. This tax is 2% of the unit’s value and is due when the property is registered with the city.

When purchasing a rental property in Las Vegas, consider the following:

- Familiarize yourself with Nevada’s landlord-tenant law, which governs landlords’ rights and responsibilities.

- Las Vegas, a popular tourist destination, consistently has a demand for rental properties.

- The city’s diverse economy provides a stable market for rental properties.

- The median rent for a one-bedroom apartment is $1,575, and for a two-bedroom apartment, it’s $1,851.

- The average price of a home in Las Vegas is $430,000.

When considering landlord insurance policies, ensure they provide coverage for covered losses such as house fires, severe weather, and other property damage. Look for coverage options that include liability coverage for medical expenses and legal fees, dwelling coverage, fair rental value coverage, and premises liability coverage. Additionally, seek out landlord insurance discounts for implementing safety measures in your rental properties.

Should I Buy Rental Property In Las Vegas

When considering whether to invest in rental property in Las Vegas, several factors come into play. It’s essential to evaluate your goals, the type of property you want, and the potential returns. Here are some key questions to guide your decision-making process:

- What are your goals for the property? Are you aiming for short-term income and capital gains, or do you prefer long-term stable monthly cash flow?

- What type of property do you want to buy? Would a single-family home, a multi-family unit, or another type of property best suit your investment strategy?

Each of these options has its own set of pros and cons, which need to be carefully weighed before making a decision.

Something Else To Think About Is The Current State Of The Las Vegas Housing Market

When considering the current state of the Las Vegas housing market, it’s essential to recognize that prices have been on the rise in recent years. However, there’s always the potential for a downturn. You must be prepared for the possibility that you may not be able to sell the rental property for as much as you paid if you need to unload it quickly.

Before making a final decision on whether or not to buy a rental property in Las Vegas, it’s important to thoroughly understand the insurance needs and potential financial implications.

Is Las Vegas A Good Place To Buy Rental Property?

Las Vegas is a great place to buy rental properties for a number of reasons. One of the biggest benefits is the high demand for rentals in the area. There are always people looking for places to live, and as a result, landlords can charge high rents, increasing rental income. Another benefit is the low cost of doing business in Las Vegas. Property taxes are relatively low, and there are few regulations that property owners need to worry about. The city is constantly growing, which means that there is a good chance that property values will continue to increase over time.

All of these factors make Las Vegas an attractive place to invest in rental properties. However, if you’re thinking about investing in the area, be sure to do your research and consult with a professional before making any decisions.

Contact a Las Vegas Property Management Company

If you’re thinking about investing in Las Vegas rental property, the best thing you can do is contact a Las Vegas property management company.A good property management company like Faranesh Real Estate & Property Management will be able to help you find the right property, negotiate favorable lease terms, and manage the day-to-day operations of your rental business. They can also assist you in obtaining landlord insurance for a rental property in Las Vegas, ensuring your rental property is protected by the appropriate landlord insurance policy.