Today I wanted to do a video that’s a little bit different. It’s a little bit more of a tip for investors that don’t have a lot of money right now or just getting into investing. This is a strategy that I advise for people to use when they’re buying rental properties.

So, just to give a little bit of back story, yesterday I closed on for a client of mine, he’s about 25 years old single guy, closed on his first property that he’s going to move into. It was a condo in Henderson a nice two-bedroom. When we were at the property, we started talking and he said, hey Wasim, I’d really like to maybe start buying a property every year and then start renting them out. So I sat down and I talked to him about this strategy and I’m going to go over it with you and I kind of wrote it down here on the board.

So this strategy really works best for people that have the flexibility to move often and when I say often, it could be every six months every year. So it’s tougher for somebody like me, that’s got a wife and kids at home. So it’s hard for me to just pack up and take everybody and go. I wrote it down here on my board. This one is really specific even. So, I started the first example with his property specifically. So you’ll see here, I’ve got the houses right here and the purchase price.

So he purchased a property at $195,000. It’s a two-bedroom condo, he bought it at $195,000. Because he’s a first-time homebuyer and he’s moving into the property, he got to take advantage of an FHA loan. So it’s a really low down payment, 3.5% down. So on $195,000, he put down $6,800. So that’s his down payment. If you go down here to the monthly payment, you’ll see at a 15-year loan his monthly payment is $1,150 and a 30-year loan his monthly payment is $800, okay?

Now that property for rent – we’ve got the rent column right here. It can rent between $1,250 and $1,300 a month. So my strategy for him is hey you move into this house or to this condo and in six months, you start looking for another place, right? So we already know that the $1,250 – $1,300 is going to cover him if he does cover his 15-year loan, it’s going to be cash flow positive on the 30-year loan, so he’s making money on this as soon as he starts renting it out and he got into it really low at $6,800 down payment.

So in six months he calls his lender and he says hey you know you say whatever reason I want to move to a different side of town. Now it works for him because again, he’s single, it’s just him, he’s flexible, he can move. So in six months hopefully he saves up another down payment and he starts looking again. Then he goes to property number two.

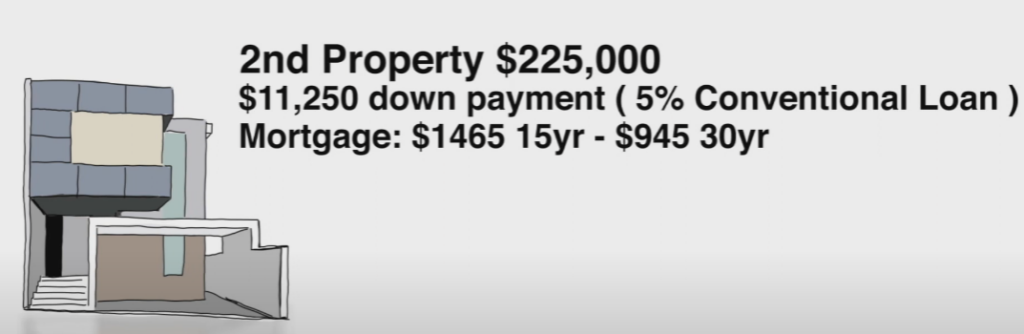

Let’s just for argument’s sake we’re going to say he buys that at $225,000. Now because you can only have one FHA loan at a time. So his next next loan and there’s programs that lenders offer. It’s a conventional loan but because he’s going to occupy it, he can now put 5% down which is very low. So just to give some perspective as an investor and I actually owned quite a few rental properties. When I buy a rental property, if I’m going to use a loan I have to put down 20% – 25% sometimes. So it’s a big difference on a down payment from 25% to 5%.

So say he buys a property at $225,000 at 5%, he’s only putting $11,250 down. Now I broke down the monthly payments again at 15 years $1,465. Now these are estimates but they’re pretty close. At a 30 year, he’s doing $945, right? That’s his monthly payment on a 30-year. So look at his rent. Still $1,450 to $1,550. Now it’s getting tough for him to cover that, that 15-year, but it still can, but it’s tougher, but he can still do the 30-year and you’ll see he’s super cash flow positive on a 30-year. So what does he do? He stays in there six months, maybe a year until he can save a little bit more for a down payment, goes to his bank and says, hey I want to move to a different side of town, right? Buys another house.

Now I’m showing the prices increasing each time. It doesn’t have to this guy can stick to the $200,000 price range, and he’s going to be cash flow positive, even on a 15-year every time. But this is just for argument sake. And when I write numbers, and when I advise investors, I’m advising real numbers and real scenarios. A lot of times I’ll see these other guys on social media or whatever and they’re telling you stuff, but there’s a lot of holes in it. You can find a lot of holes in it and this one you can’t.

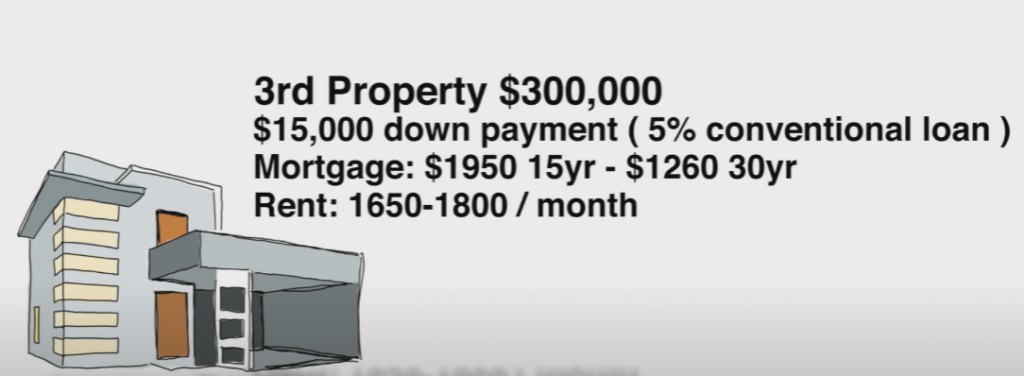

So, he goes to property number three after say a year. Down payment 5%, $15,000. Here’s your monthly payment. So now he’s probably going to start doing more 30-years, $1,260 a month. Here’s the rent on that. So you’ll see, $1,650 to $1,800 still super cash flow positive. Another year, does it again. I put it at a $350,000 price point. But you’ll see, he’s still cash flow positive on the 30-year.

So, you can do this up to 10 times, you can have 10 loans on a property. Depending on what your monthly income is, when you’re doing the 5%, that’s for somebody with with the lower monthly income, okay? It’s a way to do it everybody. I hope can save $15,000 in a year. If you can’t, I’m going to do a different video on that but I can’t help you right now. But everybody should be able to save that in about a year. Especially somebody one person that’s working. So you can do this 10 times. Now, if you space this out, say he does this over every year and a half, right? The max is 10 loans. He does this over a year and a half then 10 times a year and a half each time.

That’s going to be the end of this loan that’s going to be 15 years and that’s paid off and he can do another loan. And now this is 100% cash flow positive. So this is a really good strategy for investors to use and that way you’re building assets really quickly. Before you know it, if you’re doing 10 properties, a property every year, you’ve got ten properties that are that are cash flow positive and that are appreciating.

Just to give some more perspective, if you look at this, with the way the market has been and look at the market over the last 15 or 20 or 30 years, it’s safe to say that this guy saves these properties for 10 years or keeps building them. You could say that these properties that $200,000 that he buys could be worth $400,000 in 15 – 30 years. Now say you’ve got ten of these that’s $4,000,000 in assets, and you’ve only put $70,000 down.

That’s kind of how you build wealth and that’s a strategy to build wealth. If you want to get a little bit more creative with this strategy, I really like, but it’s not for everybody. That is, you can do this same system with multi-family properties. Say I’m a buyer and I’m looking for a four-plex, I go to the lender and say, hey, I want to buy a four-plex. I’m going to live in one of the units but I’m going to rent out the other three.

Okay, so this is really cool. So, right away, you’re moving into a house and you’re getting rental income and you can still do it with the same down payments. If it’s your first property that you’re living in you can do it with a 3.5% FHA, if it’s your first FHA. If you still have a loan out there that’s an FHA, then you can do the 5% conventional, but just to show you the numbers on that one. $350,000. And we’re going to draw this one a little bit different because it’s got four units.

So I got one, two, three four. My down payment on that and I’m going to go on the higher side, on a 5% $17,500. That’s for the 5% conventional. My 30-year payment on that is going to be about $1,470. But what’s cool here is I’m only living in one of the unit’s. I’m renting out the other three,

a four-plex, two bedrooms. Two bedroom units can rent between $850 and $900. So saying, $900 a unit times 3 we’ve got $2,700. So I’m living in one, so I’m living for free, I’m collecting $2,700, so I’m cash flow positive about $1,300, so this is I think if you can find a multi-unit that you actually want to live in that’s a great way to start being an investor and start quick and then you can repeat that process too. You can move out of one and then move into another.

The reason why I wanted to do a video that’s a little bit different than videos I’ve done is this is not stuff that we’re learning in school. A lot of parents, don’t teach this. My parents know a little bit about real estate, so they were telling me some stuff but a lot of stuff I learned here doing the work being a real estate agent for 10 years. But it’s a great system. It definitely works. The numbers that I’m using are really conservative because I want to show you that it works.

Part of what I don’t like about other videos I see on YouTube and other real estate gurus, that talk a lot of the stuff that they say, 95% – 99% of people can’t do it because they don’t have the know-how, they don’t have the cash, it’s really detailed and difficult and you’ve got to give 110% to make gains like that, but this is just buying a house moving into it and living in it. So, everybody does this, right? Or everybody should do this.

So, for more videos like this, make sure to subscribe to my YouTube channel. I want to start coming out with some more interesting topics that are geared towards investors or first-time investors.